Need Federal Student Loans? Or are you thinking about getting one?

Do you have federal student loans? Are you thinking about getting one? That is a big decision that every college student must make for himself or herself.

Just remember before you accept anything that has the word "loan" in it that it is a loan! You will have to pay it back.

Federal student loans offer a good option for those who are in special financial need. Yes, it is going into debt. Yes you will have to pay it back after you are done.

But, college loans for students might be necessary if you are in a situation where you need them.

Make a good decision by using the information that you get from this site, other financial aid sites like www.studentaid.ed.gov.

Also, throughout this whole process, keep two things in mind:

1) If you don't need to borrow, then don't.

2) If you do need to borrow, then only borrow as much as you need. Never more. The burden of debt is ever growing when you have it.

What are federal student loans?

Federal student loans are a loan from the government to help those who are pursuing an undergraduate degree or certification. Students must be enrolled at half-time student status and meet other eligibility requirements.

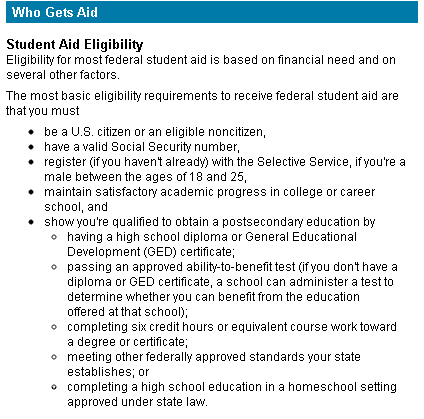

You can see the eligibility requirements listed below:

You muse meet these requirements to qualify for federal student loans.

There are also a few types of student loans. These go by the names of a Perkins loan, Direct Stafford Loan, Direct Plus (for graduates & parents), and direct loan consolidation.

Each has different purposes and is designed to help students in specific circumstances. Unless otherwise stated on the page, we will be focusing on the direct stafford student loan.

It is also important to know the difference between subsidized and unsubsidized loans.

A subsidized loan is a loan that you won't accrue interest on as long as you are enrolled at half-time status (or at another deferment period in life). The government pays or subsidizes the interest for you. This type of loan is need based.

An unsubsidized loan begins accruing interest at the time of disbursement. This loan is not need based.

Why would I need a Federal Student Loan?

Really this is a question that you need to answer for yourself. There are somethings that you need to consider before you go ahead and hit that "Accept Full Amount" button!

First of all, what are my needs? What are the needs of my family? I look at these two questions on a per month basis, but it might help you to think in terms of 3 month or 6 month intervals.

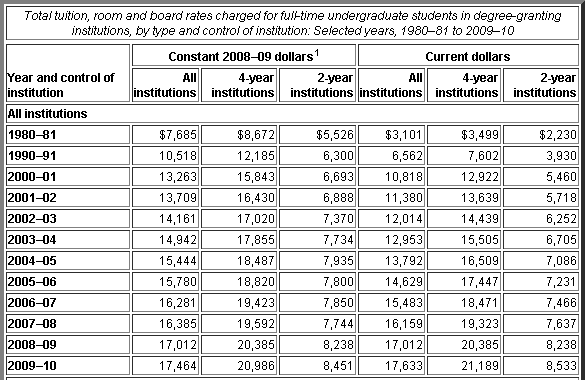

Below is a study from the National Center for Education Statistics which shows the increasing cost of college over the years. This study only includes the costs of tuition, room and board. This is based on full-time student status:

You can see the study for yourself at nces.ed.gov/fastfacts.

How does this relate to you and your situation? It may or may not, but you still need to consider a few things before accepting loans. How much do you and your family need to make ends meet? Where will that money come from?

You can start answering these questions by listing the sources of income that you have. These could be a job, parents, and other financial aid like federal college grants.

If these sources do not provide enough to help make ends meet, then figure out the difference on a per month basis, times it by four (because this is usually how long a semester is), and then condiser accepting that amount in federal student loans.

Try to get a direct Stafford subsidized loan if you can. That way you don't have to worry about accruing interest while you finish school.

Returning college students, who have been away from college for many years, might need the aid of student loans while they complete their schooling.

Having worked for many years in the labor force, you might need a certain level of income to provide for you and your loved ones (especially if you are planning on enrolling at full-time student status).

You along with your significant other (or others who might be involved) need to determine the answers the questions in this section for yourselves.

This will help you determine if a federal student loan is necessary. If you decide it is necessary, then only borrow what you need.

When can I expect federal student loans to disburse?

If you have filled out your FAFSA in a timely manner at the beginning of the year, and you have been approved for and accepted your loans, then you can expect to get a check in the mail a few weeks before the semester starts (usually between 2 to 3 weeks).

You can find out exactly when the school is going to disburse the financial aid money to you by calling or emailing your financial aid office.

You will want to make sure that everything is up to date with your FAFSA, that you have filled out and turned in any supplement forms that your school may require, and accept the amount according to your school's guidelines and procedures for accepting financial aid.

Click here to go to the FAFSA website if you haven't filled out or finished your FAFSA yet.

Remember to only borrow as you much as you need. Repaying federal student loans, and any loans for that matter, can be a lengthy process after years of college.

Something that is very important to remember is that if you ever have any questions during the financial aid process- be it about loans, grants, scholarships, etc.- that you ask your financial aid office.

Let me sum up...

All in all, you need to take responsibility for your schooling and paying for it.

In short, no. The long answer is that it depends on your situation.Do you have a family to support while going through school? Do you have a job? Do you have other financial obligations?

It is all based upon your needs and current circumstances. Looking at your individual situation will be how you determine if you need to borrow a student loan, and how much you need to borrow.

It is absolutely possible to go through school without borrowing anything. You will most likely need to find a job, draw upon savings, get help from family, and of course live frugally.

But, if that means graduating without any student loans, you'll be happier in the long run because none of your future pay checks will be going towards debt!

Finished with learning about federal student loans? Get more information on filling out your FAFSA.

Go back to college-student-answers.com